Source: Ars Technica

Article note: Whut.

All the "younger" big old players in computing have had ignominious deaths (Sun, SGI, etc.) as they crumbled. HP has disassociated into divisions that make _some_ sense. Etc.

But here goes IBM, the biggest and oldest of the surviving computing institutions, on another decade of "No apparent direction." They mismanaged their consumer-facing divisions (everything about small systems...) to death in the 90s and 2000s and divested, and now appear to be flailing the same way at everything.

What I can't tell from the announcement is where their technically interesting parts (POWER, surviving mainframe industries, Fabs, etc.) will land.

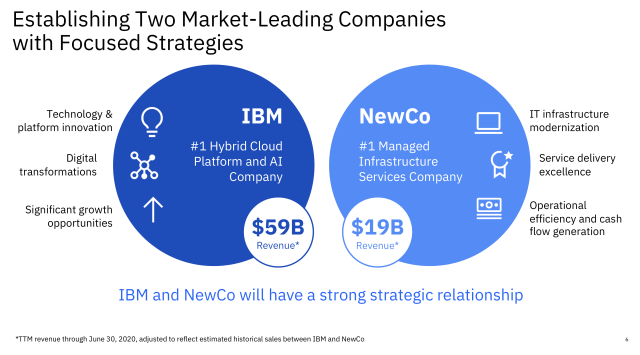

IBM announced this morning that the company would be spinning off some of its lower-margin lines of business into a new company and focusing on higher-margin cloud services. During an investor call, CEO Arvind Krishna acknowledged that the move was a "significant shift" in how IBM will work, but he positioned it as the latest in a decades-long series of strategic divestments.

"We divested networking back in the '90s, we divested PCs back in the 2000s, we divested semiconductors about five years ago because all of them didn’t necessarily play into the integrated value proposition," he said. Krishna became CEO in April 2020, replacing former CEO Ginni Rometty (who is now IBM's executive chairman), but the spin-off is the capstone of a multi-year effort to apply some kind of focus to the company's sprawling business model.

Cloudy with a chance of hitting the quarterly guidance

The new spin-off doesn't have a formal name yet and is referred to as "NewCo" in IBM's marketing and investor relations material. Under the spin-off plan, the press release claims IBM "will focus on its open hybrid cloud platform, which represents a $1 trillion market opportunity," while NewCo "will immediately be the world’s leading managed infrastructure services provider." (This is because NewCo will start life owning the entirety of IBM Global Technology Services' existing managed infrastructure clients, which means about 4,600 accounts, including about 75 percent of the Fortune 100.)

Read 2 remaining paragraphs | Comments